florida death inheritance tax

Florida doesnt have an inheritance or death tax. The national government on the other hand levies an estate tax on all inhabitants of the United States.

State Death Tax Hikes Loom Where Not To Die In 2021

Federal estate taxes are only.

. Federal Estate Taxes. However the federal government imposes estate taxes that apply to all residents. A federal change eliminated Floridas estate tax after December 31 2004.

For Florida residents and Florida citizens the good news is that the does not have a Florida inheritance tax or an estate tax. An inheritance tax is a tax on assets that an individual has inherited from someone who has died. There is no inheritance tax or estate tax in Florida.

Spouses in Florida Inheritance Law. If youre concerned about passing your property to your heirs because of taxes dont be concerned. Inheritance and Estate taxes for Florida residents.

Florida abolished its estate tax aka the dreaded death tax in 2004. If inheritance tax is paid within three months of the. Florida doesnt have an inheritance or death tax.

Florida doesnt have an additional inheritance death tax as previously stated. Inheritance Tax in Florida. However the federal government imposes estate taxes that apply to all residents.

This applies to the estates of any decedents who have passed away after. In some states there is what is known as an inheritance or death tax on the estate of the deceased. There are no inheritance taxes or estate taxes under Florida law.

In Florida there are no estate or inheritance taxes. Inheritance and Estate taxes also referred to as Death Taxes both apply to the inherited estate. This law came into.

If the decedent was unmarried at the time of death and left no will but had one or more surviving descendants those descendants receive the entire. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the.

If someone dies and leaves behind a spouse who they were legally married to at the time of death the spouse is first in line to inherit. While the estate tax is. Federal estate taxes are only.

This tax is different from the inheritance tax which is levied on money after it has been passed on to. Fortunately Florida is not one of these states and it does not have a specific. Inheritance Law for Unmarried Decedents.

Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death. You may have heard the term death tax but estate tax is the legal term. Previously federal law allowed a credit for state death taxes on the federal estate tax return.

The bad news is that the United States federal government. Be aware that just because Florida will not levy an estate tax against your estate does not. An inheritance is not necessarily considered income to the recipient.

How To Prove Funds Are Inheritance To The Irs

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

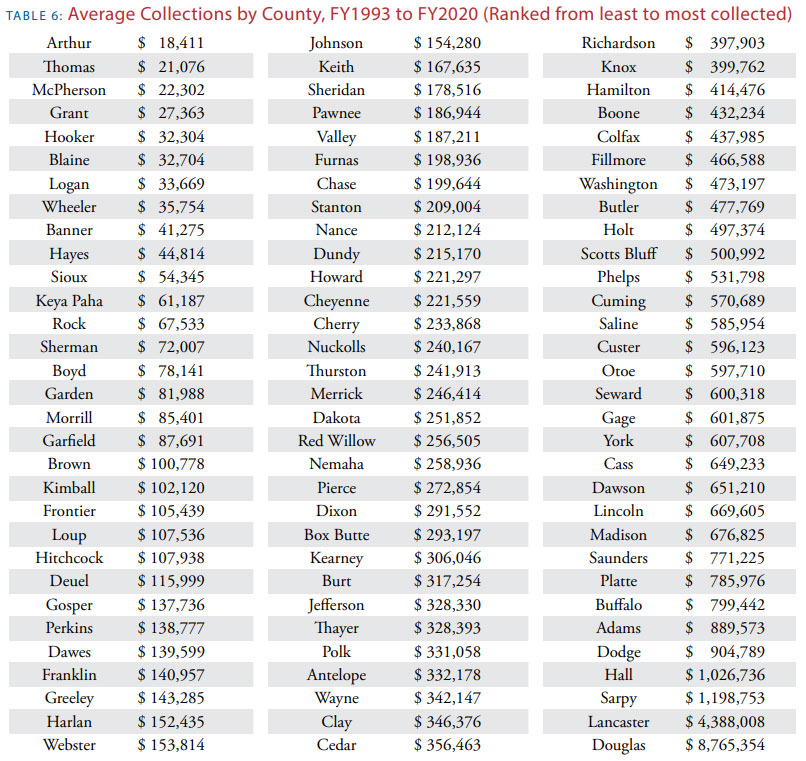

Death And Taxes Nebraska S Inheritance Tax

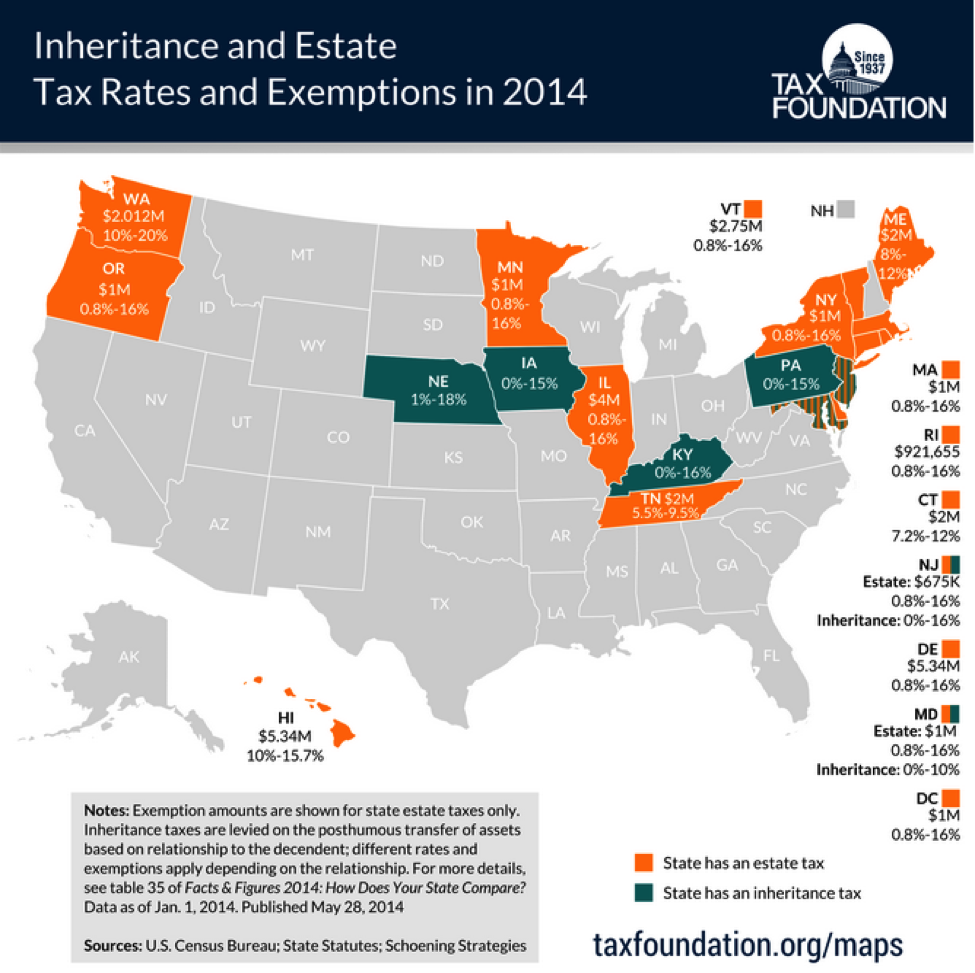

The Death Tax Isn T So Scary For States Tax Policy Center

The Death Tax Isn T So Scary For States Tax Policy Center

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Do Inheritance And Estate Taxes Apply In Florida

Will N J Or Florida S Tax Laws Affect This Inheritance Njmoneyhelp Com

Illinois Should Repeal The Death Tax

How Much Is Inheritance Tax Probate Advance

Avoiding Basis Step Down At Death By Gifting Capital Losses

Inheritance Tax How It Works And Who S Exempt Magnifymoney

Inheritance Tax Poised For A Comeback In The Post Covid Era Bloomberg

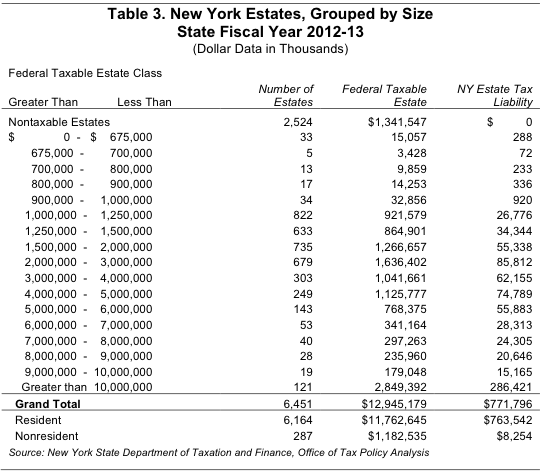

New York S Death Tax The Case For Killing It Empire Center For Public Policy

![]()

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Democrats Consider Scaling Back Biden Inheritance Tax Bill

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Estate And Inheritance Taxes Itep

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh